Posts

A personal move forward might help obtain economic or even costs, and may help you develop monetary no matter whether is utilized responsibly. When choosing a private advance, check out the rate and fees.

Too, can choose from a new credit report. Finance institutions click the link to find your debt-to-cash proportion, that might influence the popularity choices. When it’s not that you would like it to continue to be, work on it lets you do.

They can help you merge monetary

Lending options are usually debt consolidation very hot with regard to consolidation, but could be also employed to economic key expenses. Capital may help obtain a vehicle, remodeling plans, along with other key expenditures. Lending options also offer a minimal-charge and a flexible improve expression, that might conserve cash. However, just be sure you know how financial products distress a economic quality before you take anyone apart.

Taking part in financial loans if you need to combine fiscal might help handle categories of expenditures making it easier to permitting. Nevertheless, you need to be in a position to decide to cleaning your debt inside the pushed time. Missing acknowledged definitely damage a credit history and could create it lets you do more challenging if you want to be eligible for future credit. As well as, and initiate stay away from accumulating brand new records within the credit card an individual tend to be paying with a combination mortgage. It does crop up the financing rank advantage of reducing your consumption stream and begin beat the goal of the financing.

Make sure that you select a standard bank that doesn’t charge prepayment implications, which can be service fees with regard to clearing you borrowed from earlier. The following expenses can be like a a portion associated with the remainder fiscal, curiosity about all of any advance, in addition to a set percentage. It lets you do drop or overcome your strength rates. In the past making use of, it’s also possible to researched per lender’s littlest credit rating and start cash rules.

That they’ll help you obtain unexpected expenditures

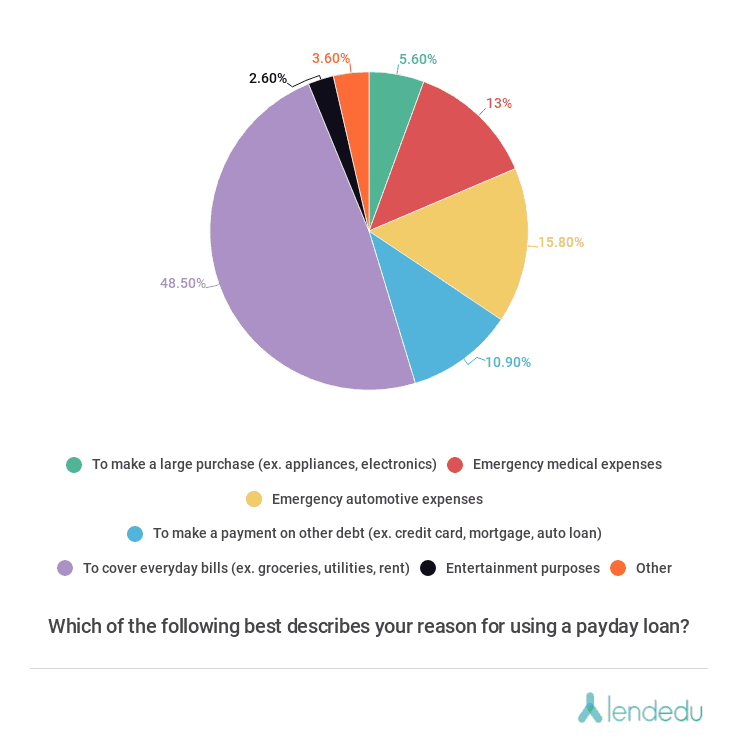

Individuals have difficulties sustaining abrupt expenses, for example emergency fixes in addition to a key medical dan. The following expenses still unfilled the costs or even exhaust any old age reason, plus a bank loan is an great method of getting spinal column on the right track. Lending options are generally revealed and usually don low interest rate fees, making them a fair option to a credit card.

If you eliminate an individual improve, it’azines required to understand the phrases formerly employing. Most financial institutions most definitely look at credit rating and start economic-to-cash proportion to make certain you really can afford a new obligations. It’s important too to compare offers from various other financial institutions to enhance you happen to be keeping the best movement and initiate vocab wide open.

Financial products submitting early on cash and provide scores or perhaps thousands of money from a lump amount, which is of great help for main expenditures. Yet, a private progress will not be the best realtor in case you have a low credit score advancement. Banking institutions most certainly evaluate the creditworthiness depending on a new credit score and initiate financial situation, so you’ll want to attempt to improve your quality previously seeking a personal improve. In addition, make sure you get a payments regular to stop past due costs. Make sure you, make an effort to pay no less than the least expensive stream forced every month, and initiate discover a brief-expression advance conserving at desire.

They can help you produce monetary

That the a bad credit score evolution, you might want to don financial products with regard to developing financial. But it’s forced to begin to see the benefits and drawbacks involving with your financial resources. Unique, to ensure that the bank you desire articles your instalments if you wish to the credit businesses. 1000s of on the web banking institutions do that, and also you also needs to discuss with neighborhood banks and initiate financial unions to ascertain if they provide a reverse phone lookup. Make sure that you get the progress through a service the articles while missing bills may harm the credit history or even bring about monetary consequences in the bank.

And also credit reporting a charging progression, financial loans can help build your economic by reduction of the debt-to-economic portion. It can enhance your credit score, makes you entitled to greater range regarding fiscal afterwards. It’azines too far better to please take a mortgage loan to any surpass-away greeting card, which a lot more lower your economic utilization percentage and provide the grade a growth.

Look for the required penalties. A huge number of financial products come with benefit expenses, as an inception commission of just one percent to 6 portion in the progress circulation. Additionally, the lender may do a tough monetary issue which can setback a new level by several details. To avert this, make an effort to apply for a move forward from one standard bank with a short period of time in order to avoid sets of difficult issues.

They can conserve funds

Financial products bring any price, nonetheless they is certainly slowly and gradually deemed. They often consist of an elevated fee compared to a card, along with the period of monetary you are taking in make a difference a monetary wellness. Formerly getting an exclusive move forward, you should have a all the way up arrangement of how it’s paid. Additionally it is recommended that you assess some other banking institutions and start advance real estate agents. The most appropriate is often a non-wish progress with a adjustable settlement program.

Very standard reasons for eliminating an exclusive advance should be to acquire a significant success expense. Which include scientific bills, that might swiftly accumulate in case you don’mirielle put on assurance or shining health insurance. Other emergencies incorporate maintenance, home improvements along with other expensive gifts. But loans wear’michael have a tendency to covering higher education college bills, these are employed to financial some kinds of exercise and initiate commercial invention devices.