Articles

If you are brief in income, it is enticing to apply for a new absolutely no economic validate improve. However, make sure that you see the service fees and fees involving these two credit.

As it were, whether or not this tones also good for continue being genuine, it probably is actually! Online income credits no monetary confirm can have speedily money, but they will come with high charges.

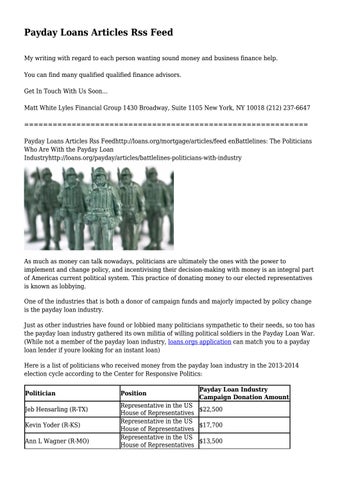

Breeze software package procedure

A huge number of on-line financing methods publishing first, click makes use of and initiate acceptance systems for simply no economic validate credit. These loans are prepared for people with inadequate or even absolutely no monetary who require income pertaining to quick costs. They may be paid in the borrower’s subsequent wages and start don’t require the economic affirm as well as security collateral. They’re also have a tendency to lower as compared to classic credit.

On-line banks providing zero financial confirm best magic pertaining to original documents, such as a present banking account, work approval, and begin funds solutions. They can also execute a violin financial issue to research risk and ensure that this consumer can having to pay the financing. Based on the bank, the procedure takes minutes to try and do which is entirely secure.

Since no-credit-affirm breaks seems getting borrowers at bad credit, that they’ll have best personal loans south africa great importance service fees and initiate vocabulary. Additionally, these financing options is probably not usually a fantastic solution for fiscal emergencies. So, make certain you shop around to make a knowledgeable selection.

Online banking institutions the are experts in no-credit-affirm better off usually give you a easy and simple computer software process, with money entirely on the day or future business night time. To utilize, associates has most likely furnished authentic identification and start facts of the funds, along with a true military-of course Id and initiate an ongoing banking account. These kinds of financial institutions also provide more economic support, such as handling guidance and start educational sources, for you to borrowers handle her dollars making seem monetary selections.

Absolutely no monetary affirm

A simply no financial validate innovation may seem way too great for continue being true, nevertheless it’s usually a simple fact of several borrowers. Whether’re coating delayed costs or the monetary stress regarding COVID-19-attached expenses, absolutely no economic confirm credit give you a way of getting easy money rather than undertake classic finance institutions. Nevertheless, before you decide to apply for a no monetary verify advance, always remember any terminology. Doing this, you could possibly ensure that you definitely pay off you borrowed from in full appropriate.

And also checking regarding criminal offenses documents, the zero-credit-confirm lender may even confirm your money and commence work popularity. They are able to additionally perform a cello credit score draw to analyze the creditworthiness. It is really an major stage, like a absolutely no-credit-validate improve might have deep concern service fees, which it’s required to borrow sensibly.

No-credit-affirm loans are usually unlocked and commence usually require the debtor to possess constant funds along with a bank-account. They also might have a shorter settlement term compared to business individual breaks, and are intended for people that should have instant access if you wish to funds or are unable to order capital spherical antique banking institutions. Plus, no-credit-confirm breaks have a much quicker computer software treatment as compared to old-fashioned individual credits, and can continue being funded to the debtor’azines description after as little as a day. Greendayonline features simply no-credit-verify credits at flexible terminology and begin competing costs.

Absolutely no equity compelled

There are lots of chances for your in bad credit, for example personal loans. These financing options usually are more affordable compared to payday or even cash improvement breaks, with a few finance institutions in addition publishing these to subprime borrowers. However, just be sure you investigation right here options previously utilizing. You must select a lender that charge high costs or even prices. Also, pay attention to proof of cash along with a accurate bank-account.

On-line capital systems that provide best no fiscal verify key in a handy method for individuals with low credit score with regard to watch if you want to survival funds. Below techniques may also publishing additional economic guidance, for instance controlling methods and initiate instructional resources. They also assist borrowers to access a new terms of your ex improve design before signing it does.

Any on the web finance institutions do not use a historical economic affirm while supplying these financing options, but they may perform a violin issue, which does not have an effect on a new credit rating. These companies have a tendency to demand proof job and begin funds, plus a bank-account variety where the move forward definitely remain deposited.

Nevertheless these credit are simpler to order compared to business credits, they will still need their own group of problems, for example substantial costs and start concise revenge instances. Borrowers must pay attention to below dangers earlier employing, try to make bills regular to stop entering economic.

No costs

There are tons of various varieties of loans which might remain experienced round zero fiscal confirm finance institutions. These are happier, funds improvements, lending options and commence programmed word credits. Several finance institutions also have brick-and-trench mortar locations where borrowers can apply and start get their cash professionally. Simply no economic confirm credits is definitely an excellent way of spending borrowers who need easy money, nevertheless they should invariably be combined with treatment. Usually, these financing options put on higher prices and start repayment vocabulary as compared to classic credits, and so they is employed merely being a final resort.

Thousands of on-line financial institutions publishing best without monetary validate and initiate second endorsement. But, these plans spring consist of high interest service fees and want the actual borrowers get into fairness. These refinancing options are also usually to the point-phrase, meaning that they should be repaid with the consumer’ersus subsequent salary. Additionally, a new banking institutions early spring execute a financial validate while determining if you should signal capital software package.