By logging and keeping track of all financial transactions, you will have easy access to any financial information you might need. To make it even easier, bookkeepers often group transactions into categories. Bank reconciliation is the process of finding congruence between the transactions in your bank account and the transactions in your bookkeeping records. Reconciling your bank accounts is an imperative step in bookkeeping because, after everything else is logged, it is the https://www.facebook.com/BooksTimeInc/ last step to finding discrepancies in your books.

Can a Hybrid of the 2 Primary Accounting Methods Be Used?

Simplicity can work for individuals or very small businesses, but not as much as a company expands. Therefore, it might make sense for a small business to start with the cash-basis approach and switch when the company requires greater accountability. TSheets is another great choice for businesses that work with employees and need to track their time. It’s an easy-to-use solution that makes it quick and simple to manage employees’ hours. Bookkeeping is important because it documents every transaction that occurs within your company.

- Review the overall security of your business records and uncover areas for improvement.

- There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards.

- When evaluating a company based on exactly when cash is on hand or paid out, it is easier to misconstrue the financial state of a business.

- By accurately recording all financial transactions, a bookkeeper can provide an accurate overview of your company’s financial health.

- Accurate record keeping is absolutely essential if you’re planning to seek funding or raise capital.

- By matching revenues with expenses, the accrual method gives a more accurate picture of a company’s true financial condition.

- When choosing an accounting method, be sure to educate yourself on its implications.

Accounting Methods You Need To Know In 2024

Although it’s simple to implement and provides accurate insights about your cash flow, cash accounting has a few downsides. Cash-basis accounting lets businesses use a mix of accounts such as cash, liabilities, assets and accounts payable. In the UK, keeping accurate financial records isn’t just good practice, it’s the law. Double-entry bookkeeping makes it easier to keep the books ‘balanced’, allowing you to better detect financial errors and fraud.

Trial balance

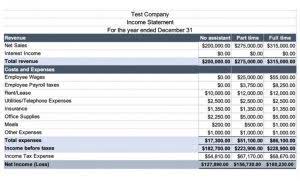

Its main objective is to provide an accurate overview of an organization’s expenses and profits. Finding the ideal accounting method for your business can be difficult when you still need to learn the basics. The right accounting method will help you record financial transactions, so you can get an overview of your business’s health. Check out our guide below to learn the different types of accounting methods and find out which might be the best choice for you. By accurately recording all financial transactions, a bookkeeper can provide an accurate overview of your company’s financial health. Accounting is the later process where all collected and complete financial data – the trial balance – is analyzed.

- The service you decide to use depends on the needs of your business and may include extra features such as payroll or tax documents.

- Records of commercial contracts have been found in the ruins of Babylon, and accounts for both farms and estates were kept in ancient Greece and Rome.

- Bookkeeping is an essential part of your accounting process for a few reasons.

- It usually requires extra training, staff, and software for it to be fast and effective.

- Each one of these is designed to track specific types of business transactions.

It shows how well the company is performing and which areas need attention. Documenting all cash flow in detail gives you a complete overview of your financial activities and your business’s financial state. Additionally, accrual-basis accounting offers a complete and accurate picture that cannot be manipulated. When evaluating a company based on exactly when cash is on hand or paid out, it is easier to misconstrue the financial state of a business. The accrual-basis approach forces everything to be accounted for in a timely manner. In the late 18th and early 19th centuries, the Industrial Revolution provided an important stimulus to accounting and bookkeeping.

Please read our review for more information on QuickBooks Online and our ratings for other top accounting software. Choosing the right accounting method requires understanding their core differences. If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging. On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done. Trying to juggle too many things at once only works to put your organization in danger. If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach.

types of bookkeeping for small businesses

Comprehensive and regular analysis of these documents allows companies to evaluate their economic status and make informed financial decisions. Small businesses must maintain an accurate record of purchases, sales, billing, and invoicing. Manual bookkeeping might suffice for businesses with a lower volume of transactions. They often use simple spreadsheets to track income, expenses, and calculate sales tax. These businesses should focus on creating a clear profit and loss statement to understand their financial performance and to help with budgeting. They perform daily accounting tasks such as recording transactions, updating financial statements, checking records for accuracy, and producing reports to management.

There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards. The following four bookkeeping methods of bookkeeping practices can help you stay on top of your business finances. While there are a myriad of courses available for bookkeeper education and training, a good deal of bookkeepers are self-taught since there are no required certifications needed to work as one.

What Are Accounting Methods?

The cash-basis system is not acceptable according to the Generally Accepted Accounting Principles, or GAAP. For companies required to comply with GAAP standards, https://www.bookstime.com/articles/bookkeeping-san-francisco the accrual-basis method is the preferred form of accounting. If you used your credit card to purchase supplies, then your cash account would decrease by $100 and your expenses account would increase by $100. For example, if you paid $100 for supplies this month using your credit card, your expenses account would increase by $100. This is the perfect choice for people who work as freelancers or run a one-person shop. This is because QuickBooks Self-Employed offers 100% coverage for your tax prep so you won’t have to spend extra time filing taxes!