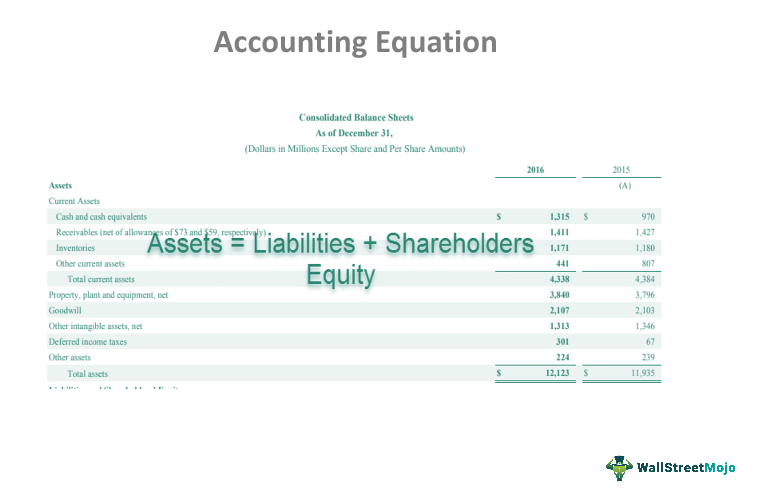

The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. As its name implies, the Accounting Equation is the equation that explains the relationship of accounting transactions. The Accounting Equation states that assets equals the total of liabilities and equity. At the same time, it incurred in an obligation to pay the bank. We know that every business holds some properties known as assets.

Great! The Financial Professional Will Get Back To You Soon.

When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system. Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation.

Get in Touch With a Financial Advisor

So, let’s take a look at every element of the accounting equation. Plus, errors are more likely to occur and be missed with single-entry accounting, whereas double-entry accounting provides checks and balances that catch clerical errors and fraud. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point. For example, if a business signs up for accounting software, it will automatically default to double-entry. On 28 January, merchandise costing $5,500 are destroyed by fire.

How confident are you in your long term financial plan?

Equity refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted. Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. Assets typically hold positive economic value and can be liquified (turned into cash) in the future.

- If an accounting equation does not balance, it means that the accounting transactions are not properly recorded.

- Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- The accounting equation matters because keeping track of each transaction’s corresponding entry on each side is essential for keeping records accurate.

- If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation.

Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights. Incorrect classification of an expense does not affect the accounting equation. However, equity can also be thought of as investments into the company either by founders, owners, public shareholders, or by customers buying products leading to higher revenue. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed.

You can find a company’s assets, liabilities, and equity on key financial statements, such as balance sheets and income statements (also called profit and loss statements). These financial documents give overviews of the company’s financial position at a given point in time. The accounting equation ensures the balance sheet is balanced, which means the company is recording transactions accurately. If a company keeps accurate staff accountant job description records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount.

In other words, the accounting equation will always be “in balance”. This equation should be supported by the information on a company’s balance sheet. The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.

Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market.